We have reached another Thursday of 2024. Do you know what that means? That...

Paladone has launched an awesome Marvel pencil holder for fans of the anti-hero Deadpool....

While Silksong does not give the air of grace, Hades 2 is, without a...

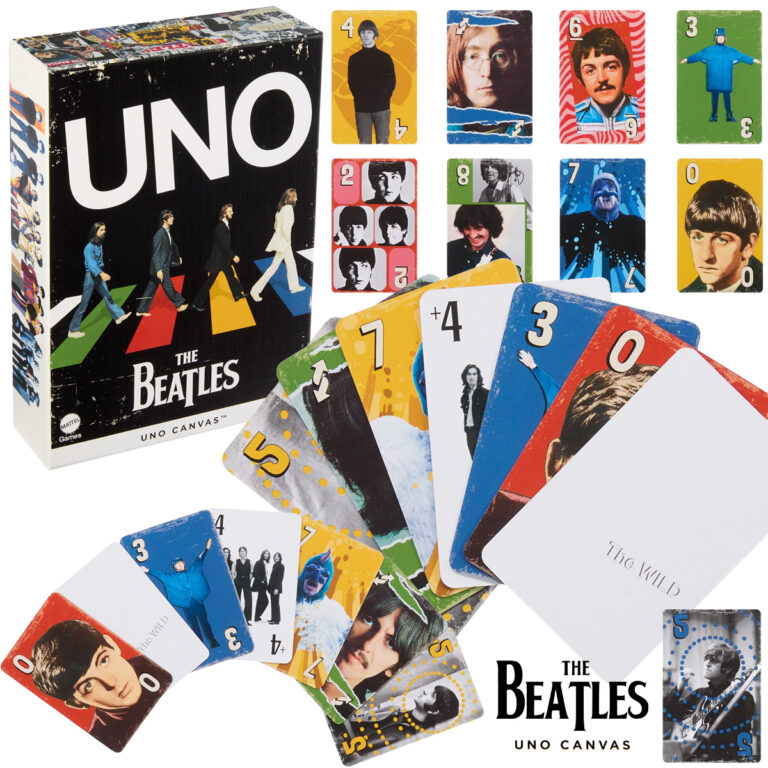

Mattel Creations has put up for pre-order a special version of the world’s best-selling...

This Thursday (18), Moon Studios finally released No Rest for The Wicked in early...

At the beginning of the month, emulation fans were taken by surprise by Apple,...

A LOUD was the grand champion of the first split of the CBLOL 2024,...

Having precision and agility when playing is essential, especially in action games where speed...

Aquarius has launched an incredible new lunch box for those who enjoy music and...

A designer known for creating creations inspired by League of Legends made a skin...

Hey, wait for it PlayStation! Let’s take a quick look at the best PS4...

After winning the paiN Gaming by 3×2in a spectacular final, o mid-laner Tinowns tied...

Dark Horse has put up for pre-order three statues of the main characters from...

A KRÜ remains undefeated in VCT Americas 2024. The heat squad beat Evil Geniuses...

After countless rumors and leaks on social media, Warhorse Studios and Deep Silver finally...

In a meeting between quotation marks e Demon 1champions of Championsa Leviathan won the...

Officially launched in Brazil in January 2024, the PlayStation 5 Slim Console has been...

A Leviatan beat NRG for 2 to 0 no VCT Americas 2024, this Sunday...

quotation marks was one of the hires of Leviathan for the VCT Americas 2024....

Loungefly has announced a special mini-backpack to celebrate the 40th anniversary of the comic...

In March of this year, Eric Barone, the solo developer behind Stardew Valley, launched...

In this article we will show you which teams beat the CBLOL (Brazilian League...

A LOUD won the paiN Gaming na final do CBLOL 2024 1° split and...

Elon Musk is a name that has been dividing opinions on social media recently....

You know which players won the most CBLOL? In this text we will show...

It has been a very atypical moment in the industry. If you’ve been following...

Among the teams already classified for the MSI 2024a LOUD is not the team...

The Erik Group has a pretty awesome cookie jar from the classic adventure film...

A LOUD is the representative of CBLOL no MSI 2024, the first international League...

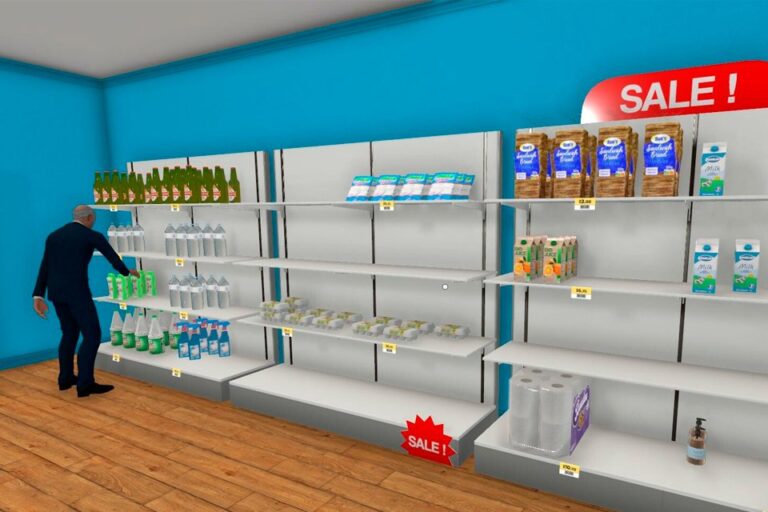

Supermarket Simulator It is a true phenomenon in Brazil. The grocery store simulator became...