It has been a very atypical moment in the industry. If you’ve been following...

Among the teams already classified for the MSI 2024a LOUD is not the team...

The Erik Group has a pretty awesome cookie jar from the classic adventure film...

A LOUD is the representative of CBLOL no MSI 2024, the first international League...

Supermarket Simulator It is a true phenomenon in Brazil. The grocery store simulator became...

For those who thought it was a joke, the tweet from brTT about being...

The newest action figure from the ReAction Rock line pays homage to the Irish...

Earning experience points (XP) in Fortnite is essential for unlocking items and costumes from...

A LOUDafter winning his fourth consecutive championship over the paiNmanaged to touch the Kaboom...

Mezco Toyz has put up for pre-order a new One:12 Collective Marvel Spider-Man action...

The weekend is finally here and, with it, our selection also arrived with some...

In the early hours of last Sunday (14), two players from the VCT Pacific...

The betting house BetBoom is the esports organization’s new long-term partner Team Spirit. The...

The time has come to enjoy the best of the gaming world without spending...

Although the Brazilian scene is eager to see the Jean Mago playing the CBLOL,...

After Fobia – St. Dinfna Hotel, the quality standard for Brazilian games has become...

The support frosty, which ended up being in the reserve of RED Canids in...

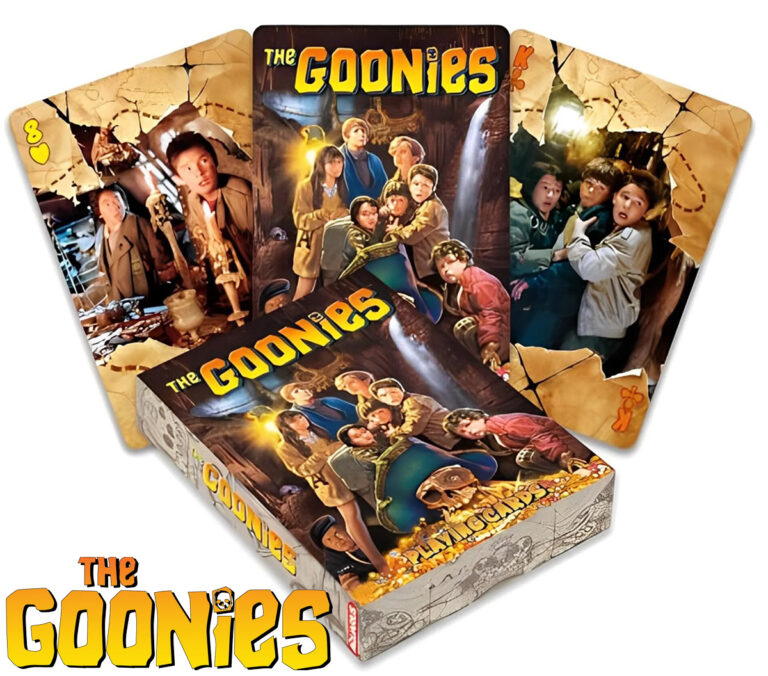

Aquarius has launched a special deck for fans of one of the best adventure...

A Kaboom must maintain the same line-up for the second split of CBLOL 2024,...

Despite the popularization of digital games due to digital editions of consoles, There are...

This Wednesday (17th) the premiere of VALORANT Game Changers Brazil 2024 Stage 1. A...

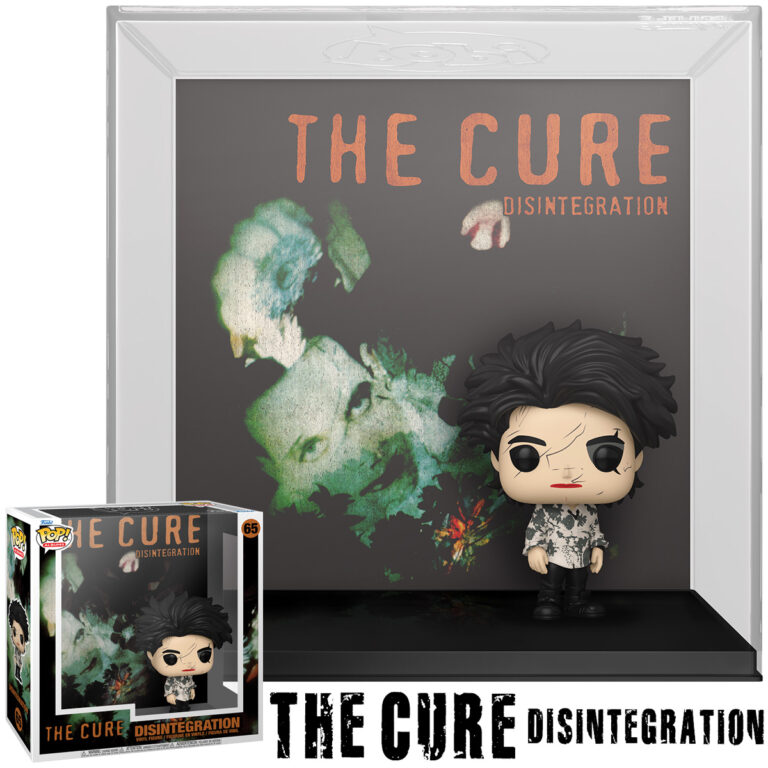

Funko has put a Pop! Albums from the eighth studio album by English rock...

Nintendo fan of our hearts, come with us to check out the promotions from...

The Franchise Era is dominated by a duo: Tinowns e Robowho reached another consecutive...

On Tuesday (16), players from VALUING on Reddit shared their weapon choices for a...

Paladone has launched one of its practical desk organizers inspired by Spider-Man with characters...

Fallout has been one of the most discussed topics on social media in recent...

The second split of LCS 2024 will mark the return of the MD3 series...

The competitive landscape of VALUING is about to witness a clash between two of...

Super7 has put up for pre-sale a set of ReAction action figures featuring characters...